Originally published 27 March 2020.

Originally published 27 March 2020.

It’s no secret, but I am not a fan of this government in normal times. None of that will have changed.

However, they have announced a help package for self-employed people that will apply to the majority of driving instructors. From what I understand at the moment, your average income for the last three years will be determined (though I believe you will still be eligible if you submitted a return for last year), and you will be paid 80% of that. It’s all explained here. You will still be liable for tax on it next year because it is still self-employed income, which is perfectly understandable. But this is where the fun begins.

It appears that many instructors still can’t work out the difference between turnover and profit/income, and are of a mind to believe that the government is going to (or should be) be paying them for overheads which they no longer have to cover right now, such as fuel and franchise/car ownership costs. Others, for unfathomable reasons, seem to expect to be paid their entire (and sometimes imaginary) income without even having to get up. This is where previous, erm, ‘creativity’ when filing your tax return comes home to roost, and if you’ve been earning close to £30k but only declaring £20k of it, then it is the latter figure you’ll be assessed on.

For the billionth time, your turnover is not called gross profit – or any other term with ‘profit’ in it. It is your turnover. HMRC will not be calculating this grant based on your turnover, and that is true no matter what stupid name you give it when you’re doing your tax return. It is how much money passes through your hands as a result of your business. In any normal year, you have to subtract business overheads from your turnover. What’s left is your trading or taxable profit. This is sometimes referred to as gross profit, and it is what you pay tax on. It is the trading/taxable profit HMRC will be using to calculate how much you’ll get from this grant – not any other kind of ‘profit’, and especially not one you made up so you could use the word ‘net’ a lot on your Excel spreadsheet. And one final thing, as long as your trading profit makes up more than half of your total income then you will still get the grant – that condition is there for people who live off investments. In other words, if you have a private pension income and also work as an instructor, then as long as your Self Assessment trading profit is more than you get from your pension (which is PAYE and HMRC knows about it already), you are still eligible.

I have to admit that GOV.UK has complicated the issue by putting ‘turnover’ in brackets next to ‘total trading income’ (aka trading profit) on it’s ‘information page’ – which doesn’t actually explain things very clearly at all. The media summaries which say you will get “80% of your taxable profits from self-employment, averaged over the last three years” is the key.

If you go on to the HMRC website and look at your account, you can see your tax statements for the last four years. Last year – the one I’ve most recently sent in as my self-assessment – my total income was around £25,000. Part of that for me is now from a private pension which I only started receiving part way through that tax year, but which means I’ve eased off the gas somewhat when it comes to worrying about cancellations and maintaining a full diary these days. The majority of it was from self-employment, though. Depending on how they do this, I estimate that they will be paying me around £1,000 per month.

That’s £1,000 a month (£230 a week) that I otherwise wouldn’t have had, which – when the payment kicks in – will be backdated to the start of March, as I understand it. As the saying goes, that is somewhat better than a poke in the eye with a sharp stick.

These are extraordinary times, and we are experiencing something no one has ever experienced before – and I include the Spanish Flu epidemic in 1918 in that (if anyone is alive who can remember it). The government paying anything – let alone 80% of income – to millions of people is unprecedented. Unprecedented with knobs on. Unprecedented to the power of ∞. And still people aren’t happy.

The vast majority of instructors have had franchises, car leases, car loans, and almost all other debts put on hold. Gas and electric companies are deferring payments. Even major lenders for mortgages are trying to help. OK, some are still stalling on it, but they’re going to have to get real and offer people something. On that alone, though, getting 80% of your normal annual income could easily leave you slightly better off in the short term until you can start earning again and the bills come back online.

In some cases, the help is automatic and is being applied as a matter of course. In others, you simply have to get off your arse and ask for it. Although they appear to snowed under, Universal Credit is open to almost everyone – especially those who have only been instructing for a short time.

I am fortunate now, and have my private pension to help me through this. That pension, with the lump sum that went with it, was originally purposed for use in retirement when I eventually get there, and it is a long way from keeping me in the manner to which I have become accustomed by itself (though it will be much closer once there is a state pension on top of it and I have no business overheads to worry about). But to have it partially protected in this way now is some comfort.

Of course, this will make many people angry – anger comes immediately after jealousy for many people. But I would point out that I have been through something very similar financially in the past. When I lost my job all those years ago, I had huge debts and zero income initially (the pension was way off). While I trained to be an ADI I was on almost the minimum wage for a part of the time, and had to negotiate with my creditors to allow reduced payments throughout that time – and that was back when they had no reason at all to want to play ball. But they did (though CapitalOne tried hard not to the entire time, with their incessant, sometimes daily, phone calls). I didn’t want to declare bankruptcy, or use it’s teenage cousin (the IVA), because of how it might affect me being an instructor and self-employed later on. My credit rating then was literally zero.

It was a struggle. But I got through it – forced my way through it, in fact – and eventually paid off all my debts. My credit rating now couldn’t be higher.

If I can do it, you can do it. You can. The only way out of situations like that – and like this one now – is to be active and proactive. To meet problems head-on and deal with them. And to accept that some degree of hardship is inevitable. Don’t get angry or start throwing hissy-fits at anyone, and be very careful if you cut off payments without clearing it with them first (don’t listen to smart arses on social media telling you to do it), because that would mean you’re defaulting on your agreement, and I can promise you that will come back to haunt you in future if you get one against your name. Yes, you might be on hold for a long time on the phone – other people are affected, too – and yes, you might get cut off. But you’re not going to get chucked out of your home anytime soon. There is a solution to every problem. You just have to find it.

I realise that the support package will not apply to those who have only been trading for a short time, and I am really sorry for you about that (obviously, the title of this article isn’t directed at you). Similarly, you’re not eligible if your main income is from somewhere else, and you only give lessons to make a bit of pocket money. Universal Credit is there if you need it, so push for it. And if it really seems like there is no way forward – or if you simply cannot do it by yourself – contact a credit management company to help you.

Once all this is over, people are going to want driving lessons again. Many will be in a position where they need to drive to be able to find work. While all this current stuff is happening, people will still be turning 17, and they will be waiting for the time when they can start taking lessons. In my case, all those people who I had to terminate lessons with last week will still be waiting (unless they were all so mercenary, they managed to find some asshole who has been teaching during the pandemic).

We can all get through it.

Edit July 2023: Just picked up a run of hits on this. I think I need to be Prime Minister, or something. Everything I predicted is precisely what actually happened – and I said it right at the start of the pandemic. I’m turning work away because of people needing to drive, and most of us got through the pandemic, didn’t we?

Since we went into lockdown, my bank has changed its interest rates, and they are certainly not for the better. It’s no big deal, and I fully understand why they’ve done it.

Since we went into lockdown, my bank has changed its interest rates, and they are certainly not for the better. It’s no big deal, and I fully understand why they’ve done it.

Today was my day to make my claim. I had already checked to see if I was eligible for the grant, and had been given today as the date to make my claim.

Today was my day to make my claim. I had already checked to see if I was eligible for the grant, and had been given today as the date to make my claim. I had an email from HMRC this morning, which

I had an email from HMRC this morning, which  Originally published 27 March 2020.

Originally published 27 March 2020. Well, Donald Trump appears desperate to outdo himself with everything he says and does. You will no doubt have heard

Well, Donald Trump appears desperate to outdo himself with everything he says and does. You will no doubt have heard

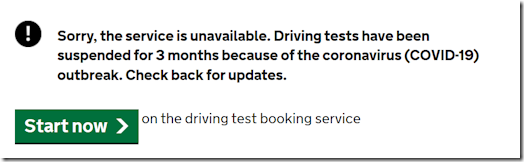

I keep seeing people saying we’ll be back working as instructors by the end of May, or in June or July. I do not see how we possibly can be.

I keep seeing people saying we’ll be back working as instructors by the end of May, or in June or July. I do not see how we possibly can be. Regarding the three-month driving test suspension, be aware that the rearranged dates in June cannot be changed right now.

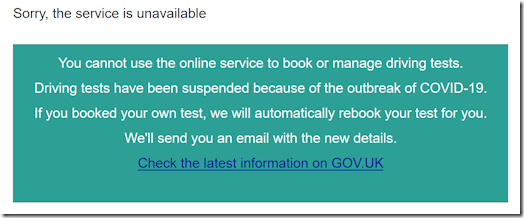

Regarding the three-month driving test suspension, be aware that the rearranged dates in June cannot be changed right now. It’s fairly clear. The entire DVSA is effectively closed as far as test bookings etc. go.

It’s fairly clear. The entire DVSA is effectively closed as far as test bookings etc. go.